Five-Star Analyst Jim Kelleher Likes These Two Technology Stocks

2022’s outlook is getting murkier day by day, with heightened fears of a recession around the corner, burgeoning inflation, rising interest rates, and the never-ending Russia-Ukraine war.

It has been 12 days since we entered a new quarter, which investors welcomed with fresh hopes. However, these hopes were soon dashed by the Fed’s consistently aggressive stance.

However, a downturn does not necessarily have to be bad news if one looks beyond the turmoil and invests in the right stocks. One way to potentially choose the right stocks is to closely follow what top-rated Wall Street experts are saying.

To make this easier for investors, we regularly highlight the world’s top experts and what stocks they are recommending, even during precarious times like these.

Today, in our Expert Spotlight piece, we celebrate one of the top analysts whose stock analyses have helped investors make constructive decisions. We will also discuss two of his recently recommended stocks.

Today’s Expert: Jim Kelleher

Our expert of the day is Jim Kelleher, Director of Research at Argus Research, who is a financial services veteran with nearly 30 years of experience in the equity research field. Kelleher has been with Argus Research since 1993 and has helped the firm build its proprietary valuation models.

He tracks the technology sector, with a special focus on communications equipment, semiconductor, electronic equipment, and information processing industries.

Kelleher is a chartered CFA, has won The Wall Street Journal’s Best on the Street All-Star Analyst Survey three times, and has published his own book — Equity Valuation for Analysts & Investors.

Based on a complex Star Ranking system, this five-star rated analyst is ranked #10 among all 7,912 analysts followed and rated on TipRanks, and #20 out of all the 20,694 experts in the TipRanks universe.

The analyst has a success rate of 69%, with an average return of 29.7% over the past year. Furthermore, his recommendations generated an alpha of 16% over the S&P 500 (SPX) index and 10.6% over the technology sector performance in the past year.

Kelleher’s most accurate stock recommendation was Wayfair (W) in the year between March 13, 2020, and March 13, 2021, during which the stock had gained a whopping 711% return.

Here are the two stocks that Kelleher recommended over the past month.

Networking systems and services provider Ciena boasts more than 2,000 patents. Despite missing its top and bottom-line estimates in the last reported quarter, the company is benefiting from higher network traffic, high bandwidth demand, and rapid cloud adoption.

The company has also been adversely affected by the supply-chain disruptions that have plagued the technology sector. However, a meaningful improvement in supply shortages and bottlenecks, largely expected to happen in 2023, is expected to benefit Ciena immensely.

In June, keeping the short-term headwinds affecting the broader market in mind, Kelleher lowered the price target on Ciena to $68 from $82. Nonetheless, he maintained a Buy rating on the stock.

The analyst believes that a challenging supply-chain environment was the main cause of the Q2 earnings miss. However, he was upbeat about the solid rate of bookings and a strong level of backlogs. Moreover, the company is trading at an attractive discount currently, compared to its peers and its own historical valuations, making it a compelling entry point, according to Kelleher.

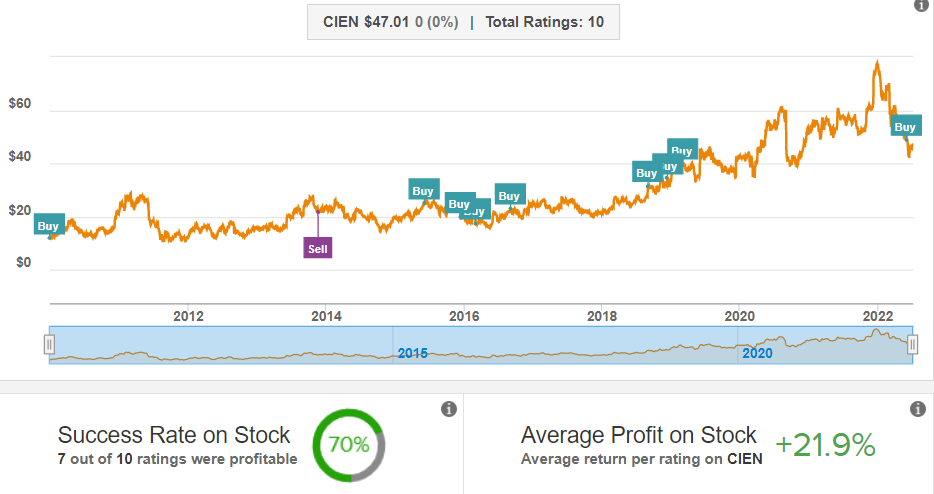

Since January 2010, Jim Kelleher has rated Ciena 10 times, out of which seven ratings were fruitful. Moreover, each of the 10 recommendations generated an average return of 21.9%.

Wall Street is also bullish on Ciena, with a Strong Buy rating based on 13 Buys and two Holds. The average CIEN price target is $67.53, indicating upside potential of 44% from current price levels.

Semiconductor company ASML Holding has its own share of challenges. The U.S. government is pressuring the company to stop selling its equipment to China. However, it has a dominant position in this domain. Thus, the demand for its equipment may see an increase in other geographical markets. This can help the company compensate for its loss of China revenues.

ASML develops, produces, and markets advanced semiconductor equipment, particularly lithography-related systems. It primarily caters to the memory and logic chip market.

Despite near-term geopolitical headwinds, one shouldn’t forget how important semiconductors are to the tech world, national defense, and our technology-dependent lives. This positions ASML as one of the top beneficiaries of the increasing demand for chips in the long run.

Kelleher is also bullish on ASML and initiated coverage on ASML stock, with a Buy rating and a price target of $590. Granted, the stock has dipped 9.4% after the analyst initiated his first research report on the stock. However, Kelleher has his eyes on the longer-term value that ASML is expected to generate.

Wall Street is optimistic about ASML, with a Strong Buy rating based on four Buys and one Hold. The average price target on ASML is $662.50, representing 51% upside potential from current levels.

Conclusion – Focus on the Long-Term Outlook

It should be remembered that the near-term outlook is blurred for the entire economy as a whole, with very few exceptions. Thus, looking at the short-term prospects of a company’s stock while considering an investment is likely not a prudent move. Rather, for stocks like Ciena or ASML, climbing the wall of worry is expected to lead to generous returns over the long run.

Disclosure

Gloss