A step-by-step guide on how to file a claim

https://www.ispeech.org/text.to.speech

You've probably seen the news that credit bureau Equifax agreed to pay nearly $700 million over its massive 2017 data breach. Some consumers could potentially end up with windfalls of up to $20,000 as part of the deal, but a majority will at least be able to claim credit monitoring services or a $125 cash payment.

But how does it work? The online claims process opened last week, so now through January 22, 2020 affected consumers can submit a form to Equifax. While the settlement provides a cash payment of up to $20,000, most people won't see that amount.

"Go into this with your eyes open," Charity Lacey, VP of communications at Identity Theft Resource Center, tells CNBC Make It. "Part of this claims process really puts the onus on the consumer to justify that they deserve that."

The online claims form is pretty easy to fill out, but if you're feeling overwhelmed, here's a step-by-step guide on how to navigate it.

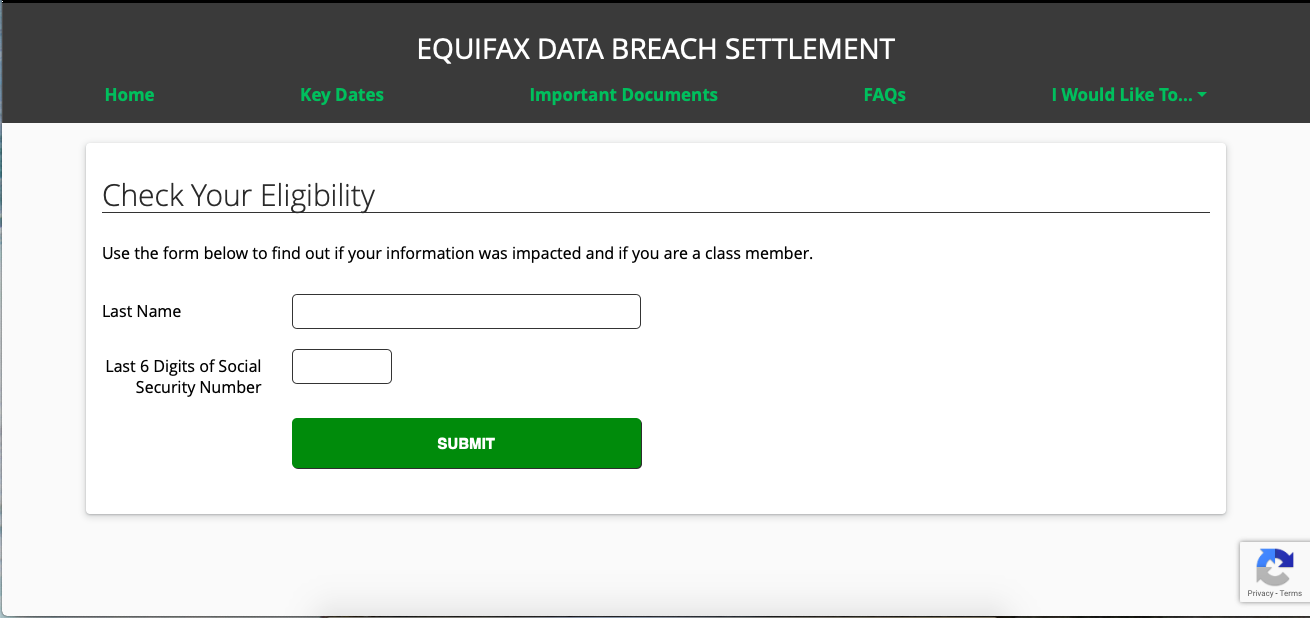

Step 1: Check if you're eligible

The Equifax data breach was one of the largest in history, with about 56% of Americans affected. You can use this online tool to submit your last name and the last six digits of your Social Security number to see if your information was compromised.

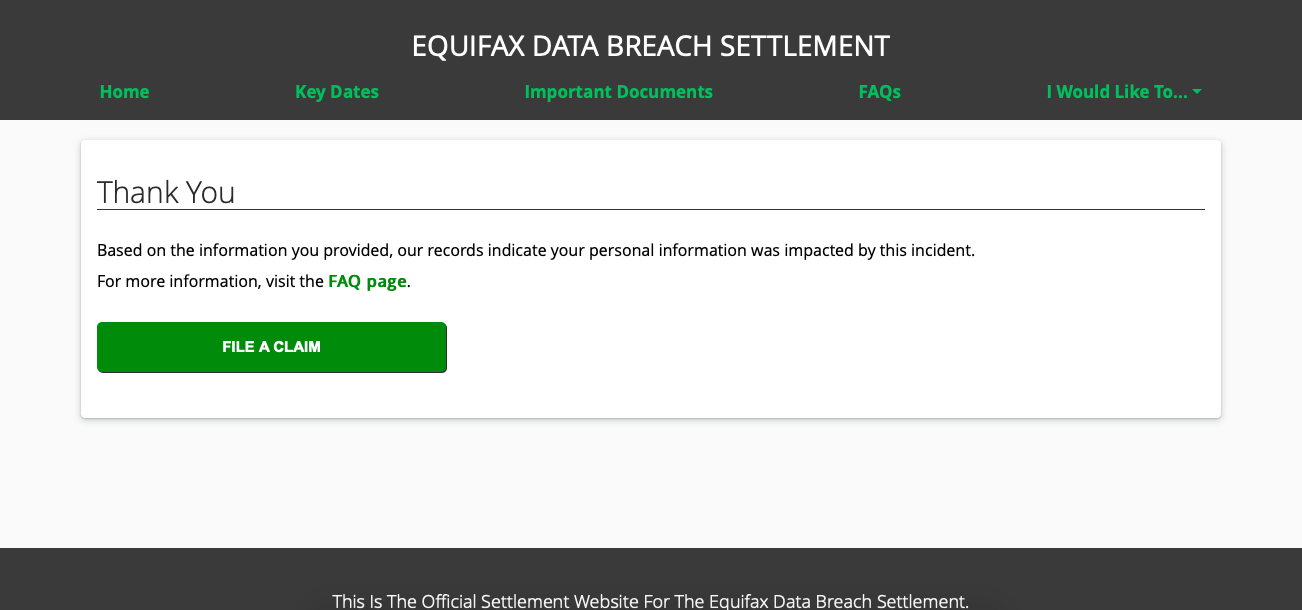

Step 2: Start the claim process

If your information has been affected, then you can start the claims process by clicking on the "File a Claim" button.

Read through the quick instructions. The process can take as little as five minutes, but it can also take longer if you're filing for reimbursement for time or money spent because of the breach. In that case, you may need to dig up receipts and documentation.

If you're not quite ready to file a claim yet, you can always return to the Equifax settlement website at a later time.

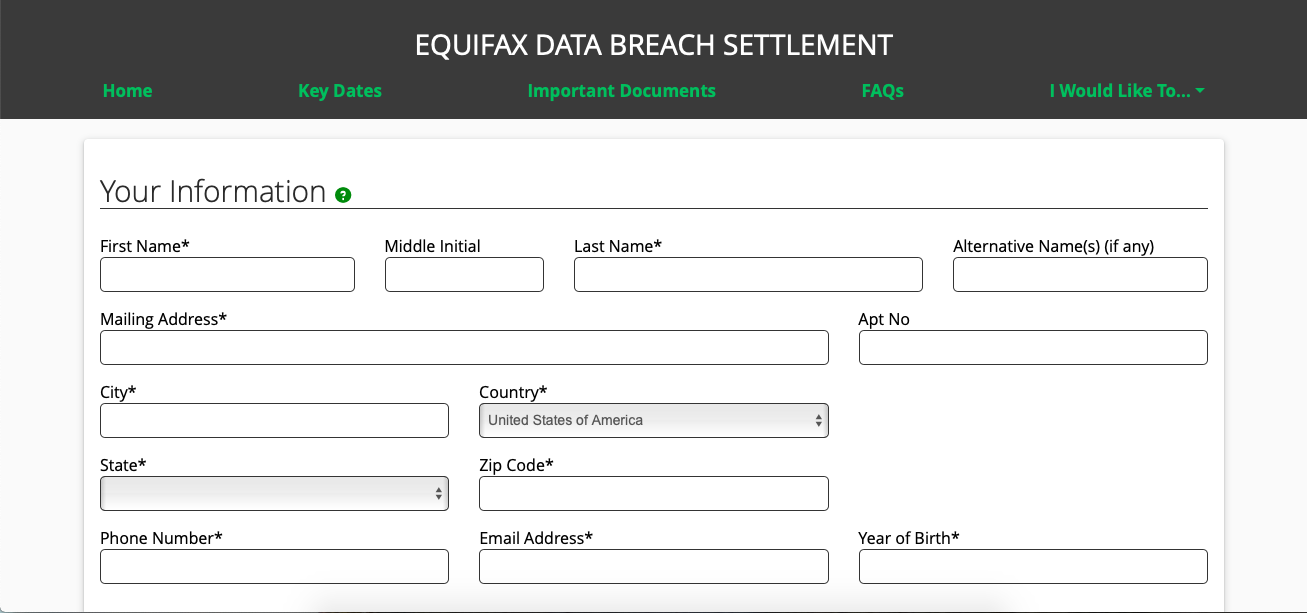

Step 3: Fill out your information

This step is pretty basic — simply fill out your name, current address, phone number, email and year of birth.

Once you're done with that, you can hit next and move onto actually claiming your part of the settlement.

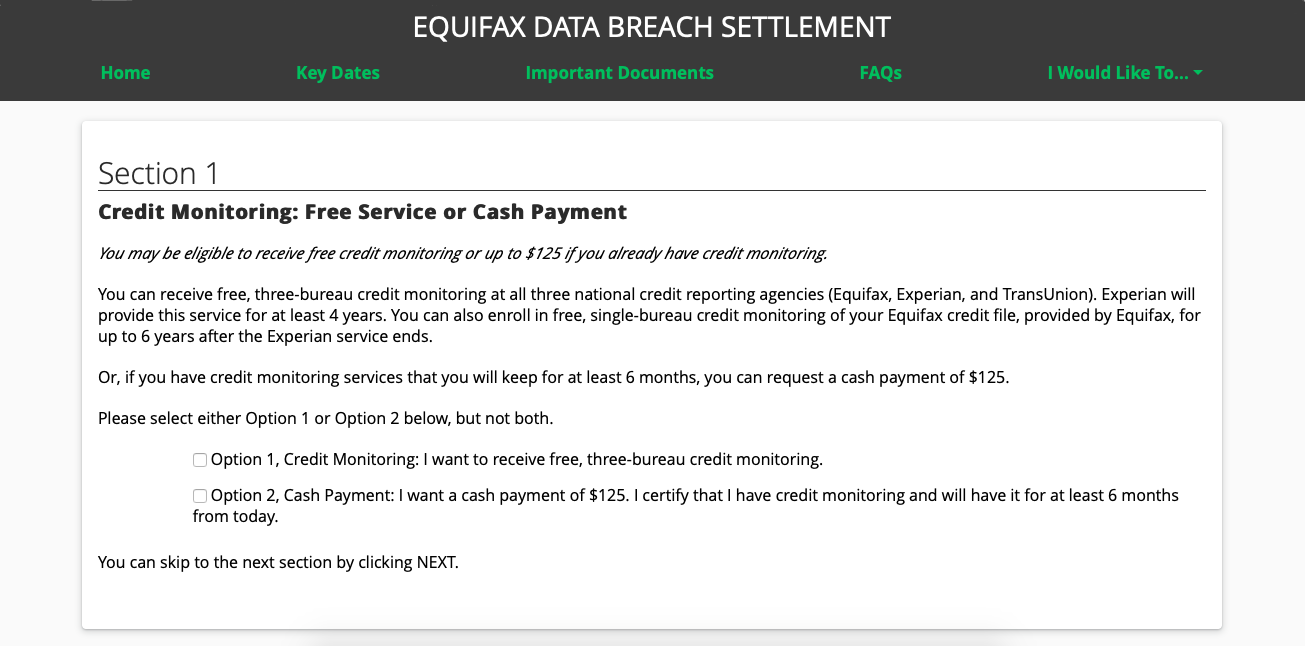

Step 4: Choose between credit monitoring and cash payment

Affected consumers have the opportunity to receive at least four years of credit-monitoring services through Experian. This service offers surveillance on your credit report on file with all three credit bureaus: Equifax, Experian and TransUnion. After four years, you will have the option to enroll in an additional six years of free monitoring with Equifax.

If you already have credit monitoring in place, you can request a $125 cash payment. But keep in mind that if you take the cash payment, you're certifying that you currently have credit monitoring and that you will have it for at least the next six months.

You cannot choose both the credit monitoring and the cash payment.

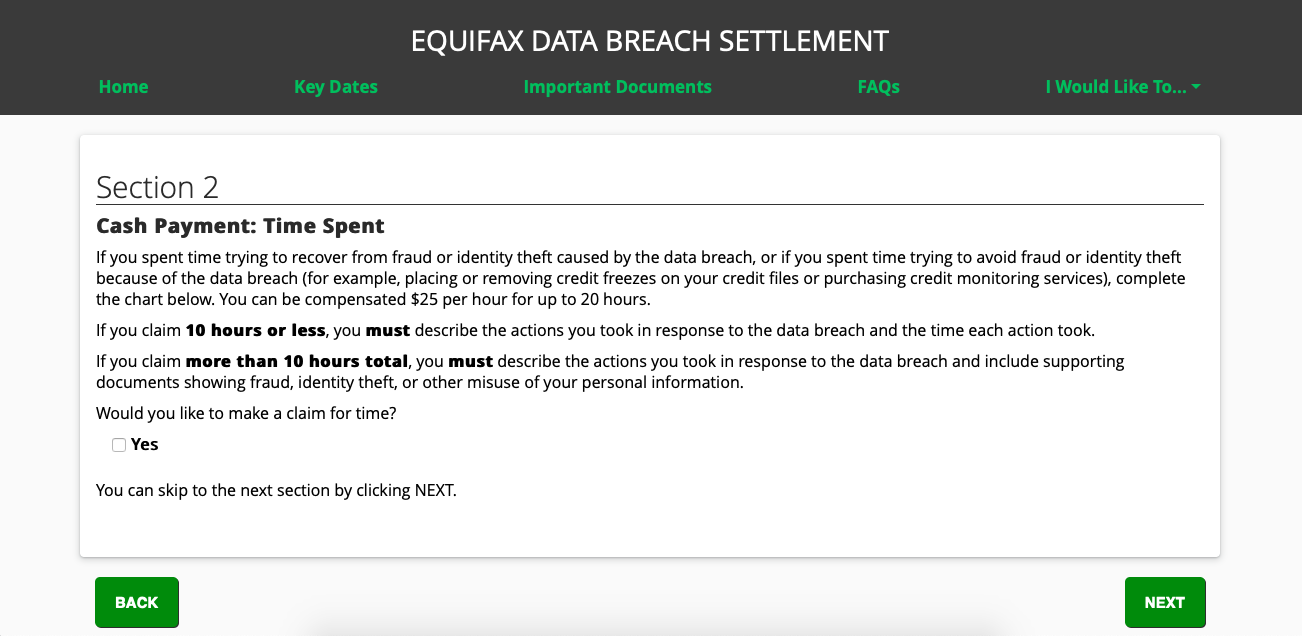

Step 5: File for time spent

Consumers can submit claims for any time they had to spend dealing with the data breach — $25 per hour, up to 20 hours, according to the FTC.

If you claim 10 hours or less of compensation, you'll need to write out the actions you took and an estimate of the time you spent on each task, the claims form says.

If you claim over 10 hours, you need to submit supporting documents "showing fraud, identity theft, or other misuse of your personal information."

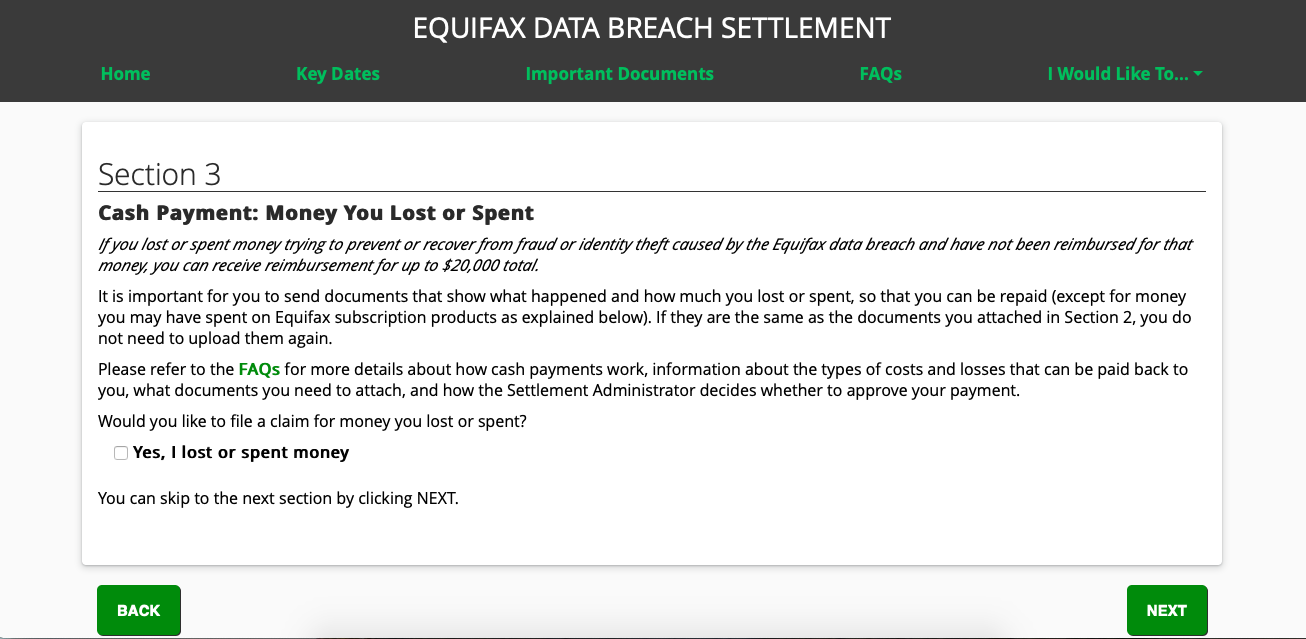

Step 6: Claim any losses or reimbursement

Consumers will be able to claim up to $20,000 for any losses or fraud that were the results of the breach or any out-of-pocket expenses they may have incurred, such as paying to freeze and unfreeze their credit reports.

You'll need to attach supporting documents, such as receipts, to show how much money you spent.

Plus, if you paid for Equifax credit monitoring or an identity theft protection subscription from September 7, 2016 to September 7, 2017, you can be reimbursed for up to 25% of your subscription payment.

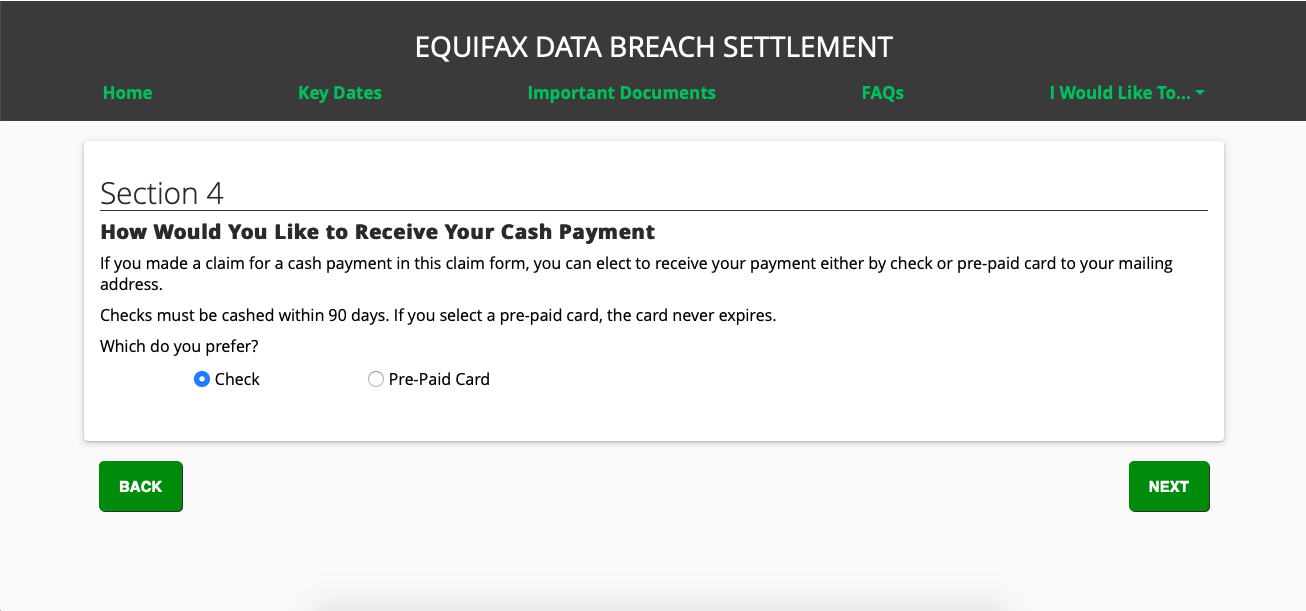

Step 7: Choose how you want to be paid

Once you've selected what claims you want to file, you'll have to pick a payment option: check or prepaid card. If you select the check, it must be cashed within 90 days, according to the claims form, while the prepaid card never expires.

Step 8: Confirm everything is correct & submit

You'll be prompted to double check that all your information is correct and certify that all your statements are true. Go through everything carefully and once you're satisfied that everything looks correct, you can hit the submit button.

Step 9: Save your claim number

If the form is processed correctly, you'll receive a claim number. If you can, print out the entire page for your records or take a screenshot. In particular, save your claim number in case you need it for reference.

The deadline to submit a claim is January 22, 2020, so the full details of how much individual payments will be may not be available until next year.

Like this story? Subscribe to CNBC Make It on YouTube!

Don't miss:

Gloss