4 Stocks to Watch in a Challenging Technology Solutions Industry – November 8, 2022

Players in the Zacks Computer – Integrated Systems industry are grappling with lingering Covid-induced supply-chain bottlenecks. A challenging macroeconomic landscape with rising inflation is also a concern. Soaring prices and persistent delays in customer acceptance have resulted in high levels of backlog and cast a pall on the industry’s prospects. Nonetheless, International Business Machines (IBM - Free Report) , ZoomInfo (ZI - Free Report) , Agilysys (AGYS - Free Report) and PAR Technology (PAR - Free Report) are a few industry participants to watch as they are benefiting from the rise in advanced forms of data management, the rapid shift from traditional silos, increased demand for integration of deployment techniques as well as modern application development.

Industry Description

The Zacks Computer – Integrated Systems industry comprises companies that provide advanced information technology solutions, including computer systems, software, storage systems and microelectronics. These industry players are increasing investments in data modernization and analytics, cyber defense, remote work, automation and contact-less services, customer & employee experience, and supply-chain modernization, which accelerate growth in digital transformation services. Some industry participants also provide technological solutions (both products and services) to aid organizations in connecting, interacting and transacting with customers. Others develop and market information recognition, data entry software, systems as well as technologies.

4 Computer - Integrated Systems Industry Trends in Focus

Integrated Solutions Driving Demand: The industry is benefiting from rising demand for integrated solutions across small, medium and large-scale enterprises, along with increasing investments in IoT, big data, AI and blockchain software technologies. Moreover, business analytics, cloud computing, mobile, and security and social businesses present significant opportunities to an increasing number of remote workers in the wake of the coronavirus-induced work-from-home wave. The industry players are anticipated to benefit from recovering global IT spending, as predicted by Gartner.

Solid Adoption of Multi-Cloud Model: The growing adoption of the multi-cloud model to achieve better scalability and attain improved resource utilization is also expanding the scope of the industry participants. Cloud and hardware/software virtual technologies are anticipated to favorably impact the industry. As growth and investment opportunities in developed countries continue to slow down, we believe that emerging economies will play a crucial role in the days ahead.

Supply-Chain Bottlenecks and Backlogs: Industry participants are witnessing supply constraints, softness in server demand and cognitive applications, as well as delays in customer acceptance, in turn resulting in high levels of backlog, particularly in Compute, High Performance Computing & Mass Storage Class and Storage. Moreover, volatility in foreign exchange — primarily due to the current macroeconomic scenario and headwinds in emerging markets — does not bode well for the industry.

Semiconductor Chip Shortage Mars Prospects: Industry participants are facing challenges owing to the ongoing and heavily time-consuming business model transition to the cloud. Further, lower spending across Data-Center Systems — primarily due to component shortages like memory and CPUs, as well as deceleration in hyperscale spending — is likely to dampen the prospects of the industry participants.

Zacks Industry Rank Indicates Bleak Prospects

The Zacks Computer – Integrated Systems industry is housed within the broader Zacks Computer and Technology sector. It carries a Zacks Industry Rank #185, which places it in the bottom 27% of more than 250 Zacks industries.

The group’s Zacks Industry Rank, which is basically the average of the Zacks Rank of all the member stocks, indicates continued underperformance in the near term. Our research shows that the top 50% of the Zacks-ranked industries outperforms the bottom 50% by a factor of more than 2 to 1.

The industry’s position in the bottom 50% of the Zacks-ranked industries is a result of a negative earnings outlook for the constituent companies in aggregate. Looking at the aggregate earnings estimate revisions, it appears that analysts are pessimistic on this group’s earnings growth potential. Since Nov 30, 2021, the industry’s earnings estimate for 2022 has moved down 15.6%.

Despite the gloomy industry outlook, a few stocks are worth watching based on a strong earnings outlook. Before we present a few stocks that you may want to consider for your portfolio, let’s take a look at the industry’s recent stock-market performance and valuation picture.

Industry Beats Sector and S&P 500

The Zacks Computer – Integrated Systems industry has outperformed the broader Computer and Technology sector and Zacks S&P 500 composite over the past year.

The industry has declined 7.2% over this period compared with the S&P 500 and broader Computer and Technology sector’s respective declines of 21.2% and 40%.

One-Year Price Performance

Industry's Current Valuation

On the basis of the trailing 12-month P/S, which is a commonly used multiple for valuing computer-integrated systems stocks, we see that the industry is currently trading at 1.59X compared with the S&P 500’s 3.44X. It is also below the sector’s trailing 12-month P/S of 4.26X.

Over the past five years, the industry has traded as high as 2.15X and as low as 1.14X, with the median being at 1.61X, as the chart below shows.

Trailing 12-Month Price-to-Sales (P/S) Ratio

4 Computer-Integrated Systems Providers to Watch

Agilysys: The company operates as a developer and marketer of hardware and software products as well as services, with special expertise in select vertical markets, including retail and hospitality in North America, Europe, the Asia-Pacific and India.

This Zacks Rank #2 (Buy) company’s expertise in enterprise architecture and high availability, infrastructure optimization, storage and resource management, as well as business continuity, is a major growth driver.

Shares of AGYS have risen 43.7% year to date.

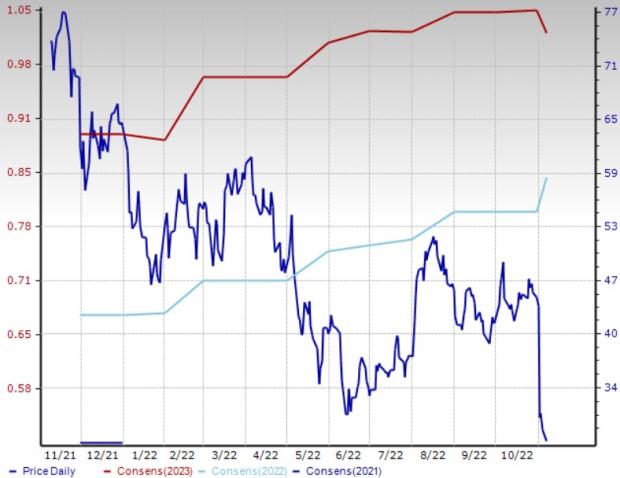

The Zacks Consensus Estimate for its fiscal 2022 earnings has moved up 3.3% to 93 cents per share over the past 30 days.

Price & Consensus: AGYS

ZoomInfo Technologies: The growing traction of this Zacks Rank #3 (Hold) company’s go-to-market intelligence platform due to elevated consumer demand for data and insights is a major positive.

ZoomInfo is benefiting from several enhancements introduced to its platform such as a real-time intelligence feed, mobile experience improvements to Quick Search, and redesigns of contact profile alerts and the homepage. The company anticipates these innovations to fuel further user engagement on its platform.

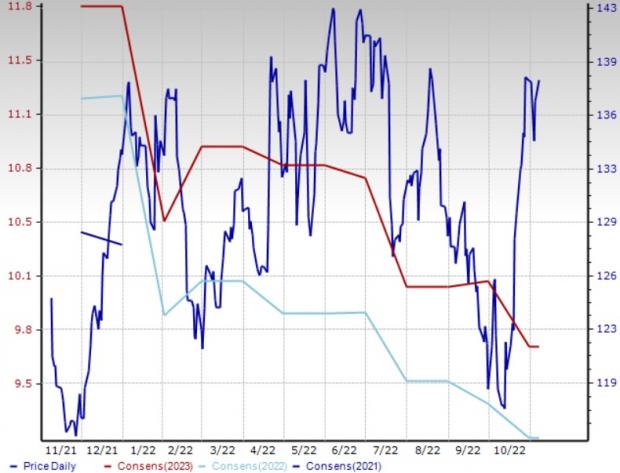

The Zacks Consensus Estimate for 2022 earnings has increased 5% to 84 cents per share over the past 30 days. ZoomInfo’s shares have decreased 56.3% year to date.

Price & Consensus: ZI

International Business Machines: This Zacks Rank #3 company is riding on strong demand for analytics, cloud computing and security.

Synergies from the Red Hat buyout are boosting its competitive position in the hybrid cloud market. The company is likely to benefit from the robust adoption and broad-based availability of IBM Blockchain World Wire — a blockchain-driven global payments network aimed at accelerating and optimizing cross-border payments.

IBM is also poised to gain from the spin-off of the legacy infrastructure services business as it focuses on a hybrid cloud strategy.

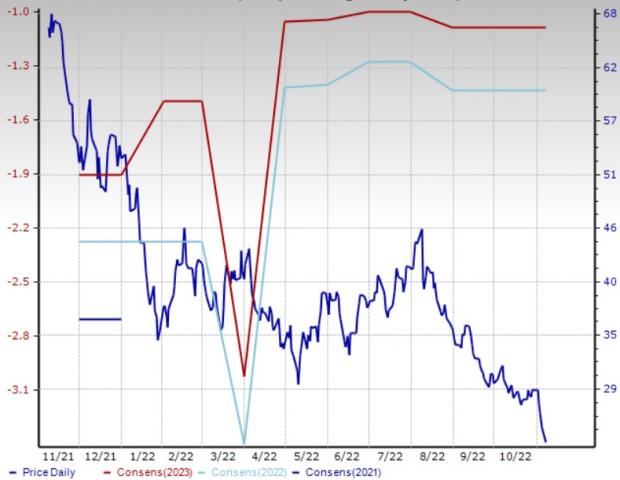

The Zacks Consensus Estimate for its 2022 earnings has moved south by 2.8% to $9.12 per share over the past 30 days. IBM’s shares are up 3.5% year to date.

Price & Consensus: IBM

PAR Technology: The company designs, develops, manufactures, markets, installs, and services microprocessor-based transaction processing systems for the restaurant and industrial market-places — Corneal Topography systems for measuring the true topography of the eye and vision inspection systems for the food-processing industry (Commercial Segment). PAR is also engaged in the design and implementation of advanced-technology computer software systems for the Department of Defense and other government agencies.

PAR has attained a position of market leadership among cloud-based restaurant management Software as a Service. The company’s software business, Brink, is growing very quickly and its restaurant cloud-based Point of Sale software is deployed over multi-brands at more than 1,000 restaurants.

The Zacks Consensus Estimate for this Zacks Rank #3 company’s 2022 earnings has remained steady at a loss of $1.43 per share over the past 30 days. PAR’s shares have declined 55.6% year to date.

Price & Consensus: PAR

Gloss